Calculate your Tax Burden for the F.Y.2024-25 and A.Y.2025-26 as per the Finance Budget 2024 by this Automatic Income Tax Calculator All in One in Excel for all Salaried Persons for the F.Y.2024-25

Tax season can be a daunting time for many of us. Whether you’re a seasoned professional or just starting out in your career, understanding your tax obligations is crucial. Fortunately, with the advancements in technology, calculating your tax burden has become more accessible than ever. In this article, Therefore, we’ll explore how you can effortlessly calculate […]

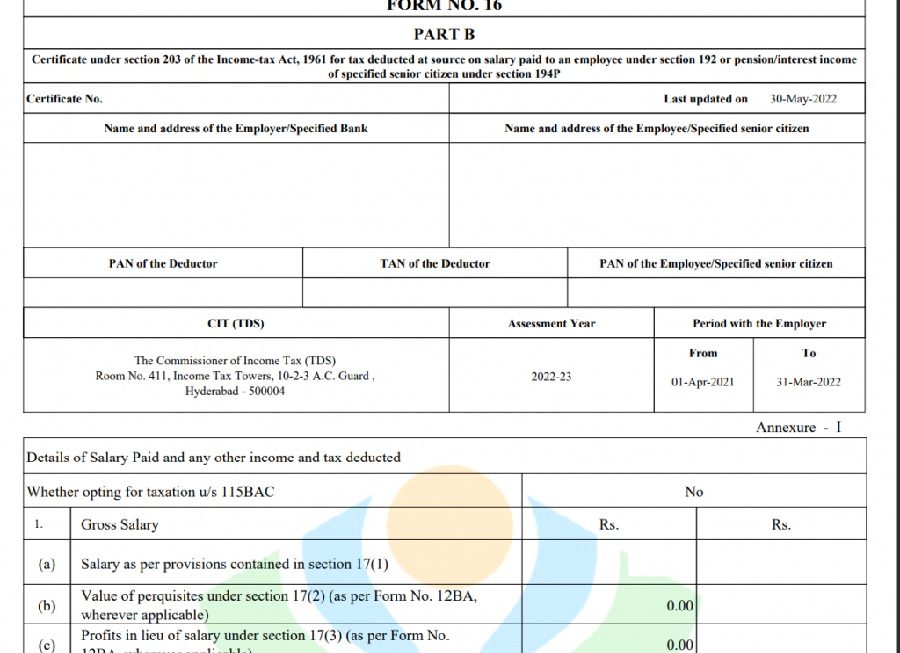

Download Automatic Income Tax 50 employees Master of Form 16 Part B in Excel for F.Y.2023-24

In the realm of taxes, preparation is key. For businesses managing a workforce of 50 employees, mastering Form 16 Part B for the financial year 2023-24 is not just beneficial; it’s imperative. Therefore, In this detailed guide, we will unravel the intricacies of Automatic Income Tax and offer insights into navigating the complexities of Form […]

Download Automatic Income Tax Calculator All in One in Excel for the All Salaried Employees for the F.Y.2024-25 as per Budget 2024

Are you ready to tackle your taxes with ease? Say goodbye to the headache of manual calculations and cumbersome spreadsheets. Introducing the Automatic Income Tax Calculator All in One in Excel for both government and non-government employees, tailored specifically for the Fiscal Year 2024-25 as per Budget 2024. Whether you’re a seasoned tax filer or […]

How to Prepare Accurate Income Tax Form 16 Part B with the Help of Excel with Automatic Form 16 Part B for F.Y.2023-24 in Excel

Income tax filing can be a daunting task, but with the right tools and guidance, it becomes much more manageable. Form 16 Part B is an essential document for salaried individuals in India, providing details of their income and tax deducted by their employer. Therefore, In this article, we’ll explore how you can efficiently prepare […]

Download Automated Income Tax Calculator All in One in Excel for the Non-Government Employees for the F.Y.2024-25 as per the Budget 2024

Are you tired of spending hours poring over complex tax forms? Therefore, Do you wish there was an easier way to manage your taxes without the headache of manual calculations? Well, In other words, you’re in luck! Introducing the Automated Income Tax Calculator All in One in Excel for the Financial Year 2024-25, designed specifically […]

The Necessity of Income Tax Form 16 with Automated Income Tax Form 16 Part B for the F.Y. 2023-24 in Excel

Are you puzzled by the significance of Income Tax Form 16? Are you looking for an easy way to download an automatically calculated Form 16 in Excel for the Financial Year 2023-24? Look no further! In this comprehensive guide, we’ll walk you through everything you need to know about Form 16, its importance, and how […]

Prepare at a time 50 Employees Form 16 Part A and B in Excel For the F.Y.2023-24

Introduction Welcome to your guide on how to prepare Form 16 for the Financial Year 2023-24! Form 16 is an essential document provided by employers to their employees, detailing their salary, tax deductions, and other relevant financial information for the year. In this article, we will break down the process of preparing Form 16 for […]

Automatic Income Tax Form 16 in Excel for the F.Y.2023-24

Introduction: Managing taxes efficiently is crucial for individuals and businesses alike. Among the various tax-related documents, Therefore, Form 16 holds significant importance. In this article, we’ll delve into the realm of Automatic Income Tax Form 16 in Excel for the Financial Year 2023-24 (A.Y.2024-25). However, Understanding Automatic Income Tax Form 16 in Excel: Automatic Income […]

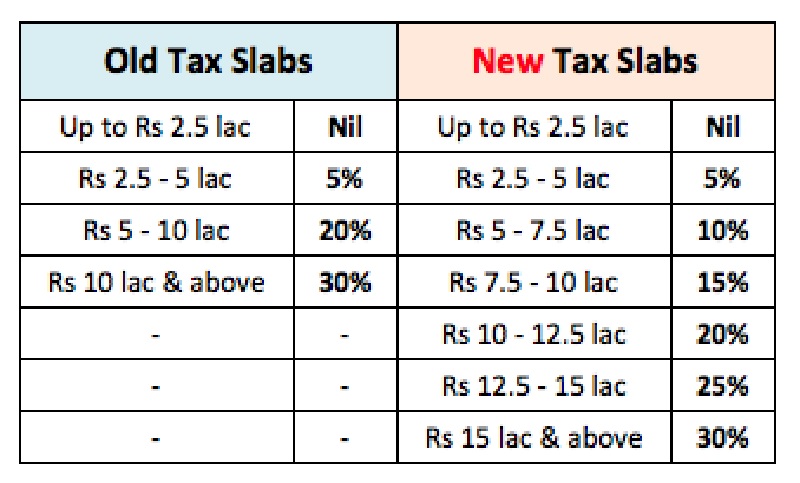

Maximizing Tax Savings: Old Tax Regime Still a Viable Option for Many

In the realm of income tax, the choice between the old and new tax regimes holds significant weight, especially for those falling within certain income brackets. While the new tax regime boasts lower rates, the allure of the old tax regime persists for numerous taxpayers owing to its array of exemptions and deductions. Let’s delve […]

Download Automatic Income Tax Form 16 Part B in Excel for F.Y. 2023-24

1. Understanding Form 16 Part B Form 16 Part B is a crucial document provided by your employer that outlines details of your salary, tax deductions, and other income sources. It serves as a certificate of TDS (Tax Deducted at Source) and is essential for filing your income tax returns. 2. Importance of Form 16 […]