Download Automatic Govt and Non-Govt Employees Tax Preparation Software All in One in Excel for FY 2025-26

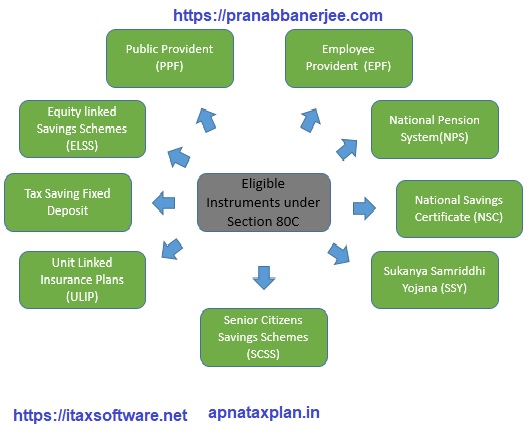

Government and non-government employees face mounting pressure during tax season. Consequently, many struggle with complex rules, manual errors, and tight deadlines for FY 2025-26. However, this all-in-one Excel-based software transforms that chaos into streamlined efficiency, empowering users to prepare taxes confidently. Core Benefits This tool first automates income calculations, then applies Budget 2025 slabs, and […]

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26

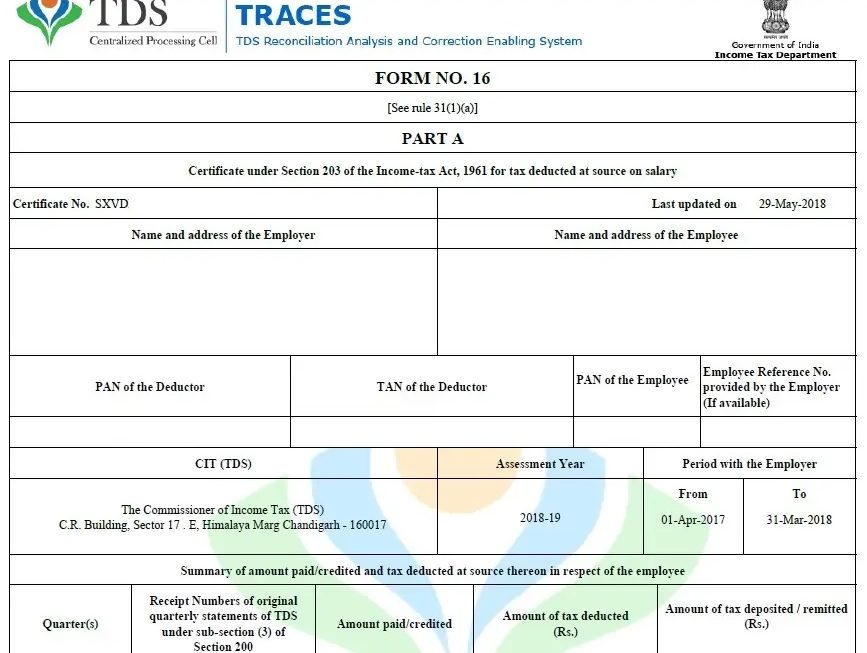

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26 Employers streamline tax compliance by generating Form 16 certificates in bulk using Excel. This approach saves time for preparing documents for 50 employees during FY 2025-26 (AY 2026-27). What is Form 16? Form 16 certifies Tax Deducted at […]

Prepare At a time 50 Employees Automatic Income Tax Form 16 Part B Excel FY 2025-26 | Free Guide & Features

Employers streamline Form 16 Part B preparation for FY 2025-26 using Excel automation. This approach ensures accuracy and compliance with Income Tax Department rules. Form 16 Part B Overview Form 16 Part B details salary components, exemptions, deductions, and tax computations for salaried employees. Consequently, it supports seamless ITR filing under AY 2026-27. Moreover, it […]

Prepare at a time 50 Employees Automatic Income Tax Form 16 Part B for FY 2025-26 in Excel

Preparing Automatic Income Tax Form 16 Part B for FY 2025-26 in Excel has become a priority for employers, accountants, and tax professionals. As tax compliance grows more structured, organisations need faster, more accurate, and error-free solutions. Therefore, automated Excel-based systems simplify the entire process. Moreover, they reduce manual effort and eliminate repetitive calculations. In […]

Automatic Income Tax Preparation Software in Excel for Govt & Non-Govt Employees for FY 2025-26

Paying income tax often feels like carrying a heavy bag uphill. However, what if you could replace that burden with a smooth trolley? That is exactly what Automatic Income Tax Preparation Software in Excel does for the FY 2025-26. Instead of struggling with manual calculations, confusing rules, and last-minute panic, you can now plan, calculate, […]

Download and Prepare at a Time 50 Employees Form 16 in Excel for FY 2025–26

Firstly, preparing income tax documents accurately saves time and avoids future complications. Secondly, employers must issue Form 16 correctly to every employee before the due date. Moreover, when an organisation manages 50 employees, manual preparation becomes complex. Therefore, downloading and preparing Form 16 in Excel for FY 2025–26 offers a practical solution. Additionally, Excel-based automation […]

Download and Prepare Automatic Form 16 in Excel for 50 Employees (FY 2025-26)

Issuing Form 16 can feel like packing 50 lunches at once, because one missing item slows everything down. Still, you can finish on time if you follow a repeatable flow. First, remember the common deadline: employers typically issue Form 16 by June 15 of the next financial year (so June 15, 2026, for FY 2025-26). […]

Prepare One by One Automatic Income Tax Form 16 for the FY 2025-26 in Excel

Preparing income tax documents often feels like walking through a maze, doesn’t it? However, when it comes to Form 16, clarity matters more than speed. Fortunately, with Form 16 in Excl Format, you can now prepare the Automatic Income Tax Form 16 for FY 2025-26 step by step, one employee at a time, without confusion. […]

Prepare 50 Employees Form 16 Part B in Excel for FY 2025-26 – A Complete Step-by-Step Guide

Preparing income tax documents often feels like juggling too many balls at once. However, when you need to prepare Form 16 Part B in Excel for 50 employees for FY 2025-26, the pressure can multiply fast. Still, what if the process could be smooth, structured, and even predictable? Thankfully, with the Automatic Income Tax Form […]

Download Automated Income Tax Form 16 Part B in Excel for AY 2025-26

Paying taxes is unavoidable. However, managing tax documents does not have to be stressful. In fact, it can be surprisingly simple. If you are a salaried employee or an employer, you already know how important Form 16 Part B is. Yet, many people still struggle with manual preparation. As a result, errors creep in. Consequently, […]