Introduction to Income Tax Calculation

Income tax calculation is a crucial aspect of financial management for individuals, whether they are government or non-government employees. Therefore, It determines the amount of tax an individual owes to the government based on their income, deductions, and exemptions.

In other words, the Importance of an Automatic Income Tax Calculator

With the complexity of tax laws and the constant changes in regulations, an automatic income tax calculator becomes indispensable. However, It simplifies the process of tax calculation and ensures accuracy, saving time and effort for taxpayers.

Overview of Form 10E in Income Tax Calculation

Form 10E is a form prescribed by the Income Tax Department of India for claiming relief under Section 89(1) by employees for arrears or advance salary received. It is essential for employees who receive arrears or advance salary to prevent double taxation.

Features of an All-in-One Automatic Income Tax Calculator

An all-in-one automatic income tax calculator is a comprehensive tool that integrates various functionalities to streamline the tax calculation process. Some key features include:

- Automated calculation of taxable income

- Incorporation of the latest tax slabs and rates

- Inclusion of deductions and exemptions

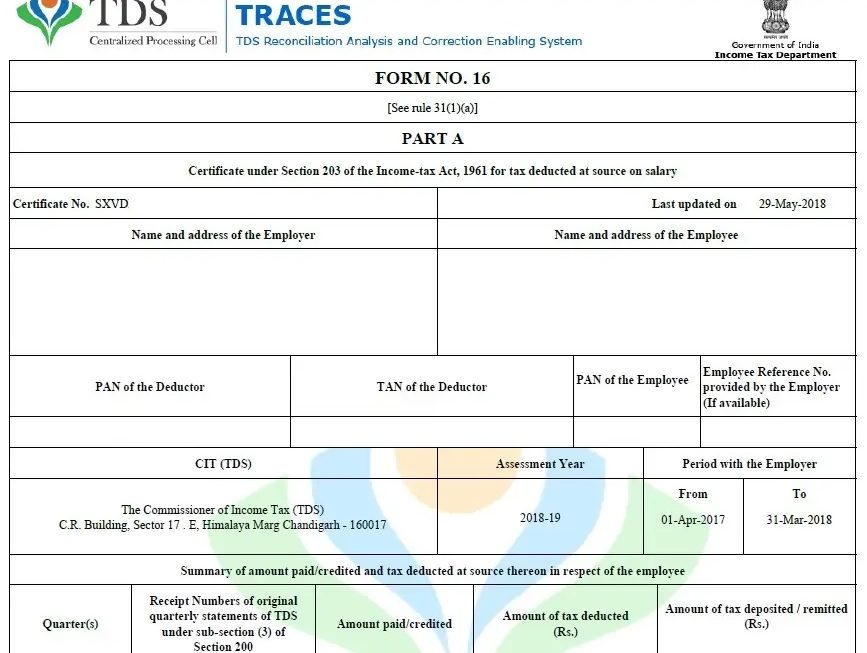

- Generation of Form 16 and other relevant forms

- Compatibility with Excel and other spreadsheet software

Benefits for Government Employees

Government employees often have different allowances and perks compared to their counterparts in the private sector. An automatic income tax calculator tailored for government employees considers these intricacies, ensuring accurate tax calculations and maximizing savings.

Benefits for Non-Government Employees

Non-government employees, including salaried individuals and freelancers, also benefit from using an automatic income tax calculator. It helps them optimize their tax planning strategies, identify eligible deductions, and minimize tax liabilities.

Above all, How to Use the Automatic Income Tax Calculator

Using an automatic income tax calculator is simple and intuitive. Users need to input their income details, deductions, and exemptions into the designated fields. The calculator then processes this information to generate a comprehensive tax summary.

Step-by-Step Guide for Filling Form 10E in Excel

Filling Form 10E in Excel requires attention to detail to ensure accurate reporting of income and relief claims. Here’s a step-by-step guide to assist taxpayers:

- Download Form 10E from the official website of the Income Tax Department.

- Open the form in Excel or any compatible spreadsheet software.

- Fill in personal details such as name, PAN, and assessment year.

- Enter details of salary, arrears, and tax deducted at source (TDS).

- Calculate relief under Section 89(1) for each relevant financial year.

- Verify the accuracy of the information provided.

- Save the completed form for future reference.

Understanding Tax Deductions and Exemptions

Tax deductions and exemptions play a vital role in reducing taxable income and lowering overall tax liabilities. Common deductions include those under Section 80C for investments, Section 80D for health insurance premiums, and Section 24 for home loan interest.

Tips for Efficient Tax Planning

Efficient tax planning is essential for optimizing tax savings and maximizing disposable income. Some tips for effective tax planning include:

- Investing in tax-saving instruments such as PPF, ELSS, and NSC

- Making timely contributions to EPF and NPS accounts

- Availing deductions for expenses related to education, medical treatment, and housing

Common Mistakes to Avoid

Inaccurate reporting and oversight can lead to errors in tax calculation and unnecessary penalties. Some common mistakes to avoid include:

- Failing to disclose all sources of income

- Neglecting to claim eligible deductions and exemptions

- Incorrectly filling out Form 10E for relief under Section 89(1)

- Ignoring updates and amendments to tax laws for the relevant financial year

Latest Updates and Amendments for F.Y.2023-24

The financial year 2023-24 may bring significant changes to income tax laws, including revisions to tax slabs, deductions, and exemptions. Taxpayers must stay informed about these updates to ensure compliance and optimize their tax planning strategies.

Comparison with Traditional Tax Calculation Methods

Traditional tax calculation methods often involve manual calculations or reliance on tax consultants, which can be time-consuming and prone to errors. In contrast, an automatic income tax calculator offers a more efficient and accurate alternative, making it the preferred choice for modern taxpayers.

Future Trends in Income Tax Calculation

The future of income tax calculation is likely to be driven by technological advancements, including artificial intelligence and machine learning. These technologies will further automate the tax calculation process, providing taxpayers with real-time insights and personalized recommendations.

Conclusion

In conclusion, an automatic income tax calculator all-in-one for government and non-government employees with Form 10E in Excel for F.Y.2023-24 is a valuable tool for simplifying tax compliance and optimizing savings. By leveraging the features of such a calculator and staying informed about the latest tax laws and updates, taxpayers can navigate the complexities of income tax calculation with ease and confidence.

Unique FAQs

- Can I use the automatic income tax calculator for multiple financial years? Yes, most automatic income tax calculators are designed to accommodate calculations for multiple financial years, including past and future years.

- Is Form 10E applicable to all taxpayers? No, Form 10E is specifically for employees claiming relief under Section 89(1) for arrears or advance salary received.

- Are there any restrictions on the use of deductions and exemptions? Tax laws impose certain conditions and limits on the eligibility and quantum of deductions and exemptions, which taxpayers must adhere to.

- **How often

- How often are automatic income tax calculators updated with the latest tax laws? Automatic income tax calculators are typically updated periodically to reflect changes in tax laws, ensuring accurate calculations for users.

- Can freelancers and self-employed individuals use automatic income tax calculators? Yes, many automatic income tax calculators are designed to accommodate various types of income earners, including freelancers and self-employed individuals.

Conclusion

In conclusion, an all-in-one automatic income tax calculator with Form 10E in Excel for F.Y.2023-24 offers convenience, accuracy, and efficiency in tax planning and compliance for both government and non-government employees. By leveraging its features, taxpayers can navigate the complexities of income tax calculation seamlessly while maximizing their savings and staying compliant with the latest tax laws.

Download the All-in-One Auto Calculate Income Tax Preparation Software in Excel for both Government and Non-Government Employees, including Form 10E for the Financial Year 2023-24 as per the Budget 2023.

Key Features of this Excel Utility:

- Calculates income tax according to the New Section 115 BAC, applicable for both the New and Old Tax Regimes.

- Provides an option to select either the New or Old Tax Regime.

- Offers a unique Salary Structure tailored for both Government and Non-Government Employees.

- Includes an Automated Income Tax Arrears Relief Calculator under Section 89(1) with Form 10E, covering the financial years from 2000-01 to 2023-24 (Updated Version).

- For instance, Generates Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2023-24.

- Provides Automated Income Tax Revised Form 16 Part B for the Financial Year 2023-24.