Tax season burdens many salaried individuals in India. However, an automatic income tax preparation software in Excel changes that dynamic for FY 2025-26. Consequently, both government and non-government employees save hours while ensuring full compliance. Key Benefits This all-in-one tool automates complex calculations. Firstly, it handles salary structures, including dearness allowance and bonuses. Secondly, it […]

Download Automatic One by One Preparation Tax Form 16 in Excel FY 2025-26

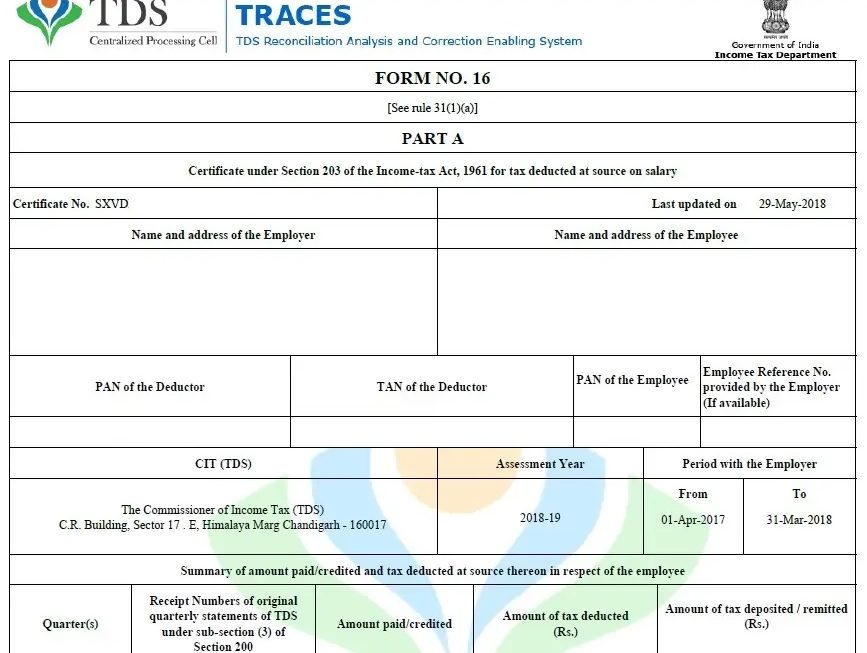

Employers rush to prepare Tax Form 16 for FY 2025-26 as deadlines approach. This automatic Excel tool simplifies the process, generating forms one by one with precision. Consequently, you save time and maintain accuracy. What is Form 16? Employers issue it to employees, proving salary payments and tax deposits. Moreover, it splits into Part A […]

Automatic Income Tax Arrears Relief Calculator with Form 10E in Excel for FY 2025-26

Salaried employees often receive arrears, which push them into higher tax brackets unexpectedly. Consequently, they qualify for relief under Section 89(1) of the Income Tax Act. Therefore, an Automatic Income Tax Arrears Relief Calculator in Excel with Form 10E streamlines this process for FY 2025-26 (AY 2026-27). Moreover, this tool automates calculations, reduces errors, and […]

Download Automatic Govt and Non-Govt Employees Tax Preparation Software All in One in Excel for FY 2025-26

Government and non-government employees face mounting pressure during tax season. Consequently, many struggle with complex rules, manual errors, and tight deadlines for FY 2025-26. However, this all-in-one Excel-based software transforms that chaos into streamlined efficiency, empowering users to prepare taxes confidently. Core Benefits This tool first automates income calculations, then applies Budget 2025 slabs, and […]

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26 Employers streamline tax compliance by generating Form 16 certificates in bulk using Excel. This approach saves time for preparing documents for 50 employees during FY 2025-26 (AY 2026-27). What is Form 16? Form 16 certifies Tax Deducted at […]

Automatic Income Tax Preparation Software in Excel for Govt & Non-Govt Employees for FY 2025-26

Paying income tax often feels like carrying a heavy bag uphill. However, what if you could replace that burden with a smooth trolley? That is exactly what Automatic Income Tax Preparation Software in Excel does for the FY 2025-26. Instead of struggling with manual calculations, confusing rules, and last-minute panic, you can now plan, calculate, […]

Prepare at a Time Automatic Income Tax Computed Sheet for FY 2025-26

Let’s be honest—income tax preparation often feels like solving a puzzle with missing pieces. You sit with salary slips, allowances, exemptions, and forms, and yet something always feels incomplete. However, what if one Excel file could do it all for you—smoothly, accurately, and automatically? That is exactly what All in One Tax Preparation Software in […]

Download Automatic Income Tax Computation Sheet in Excel for Govt & Non-Govt Employees FY 2025-26 | HRA, Arrears U/s 89(1), Form 10E & Form 16

Paying income tax often feels like solving a puzzle without the picture on the box, doesn’t it? However, what if you could simplify the entire process with just one smart Excel file? That is exactly why the Automatic Income Tax Computation Sheet in Excel for FY 2025-26 is becoming popular among both Government and Non-Government […]

Download Automatic Income Tax Preparation Software in Excel for Govt & Non-Govt Employees (FY 2025-26)

Filing income tax often feels like solving a complex puzzle, doesn’t it? You sit with salary slips, deductions, exemptions, and multiple forms, yet clarity seems miles away. However, things have changed for the better. With Automatic All-in-One Tax Preparation Software in Excel, tax calculation is no longer stressful. Instead, it becomes smooth, predictable, and even […]

Download Automatic Income Tax Arrears Relief Calculator in Excel U/s 89(1) with Form 10E from FY 2000-01 to FY 2025-26

Have you ever received salary arrears and suddenly felt confused about your tax burden? If yes, you are not alone. In fact, many salaried taxpayers face this exact situation every year. Salary arrears often look like a blessing at first. However, soon afterwards, they can feel like a burden because they push you into a […]