Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you instantly simplify the entire process. Since more employees actively search for convenient solutions, you naturally appreciate a tool that saves time, boosts accuracy, and reduces confusion. Moreover, because the F.Y. 2025–26 rules include significant changes, you benefit even more when you download software that already incorporates updated slabs, deductions, and Form 10E automation.

Transition words such as furthermore, additionally, consequently, therefore, similarly, however, and many others help connect ideas smoothly throughout this article. Here, you will explore everything—from features and benefits to download instructions—so you can confidently prepare your taxes.

Introduction to Automatic Income Tax Preparation Software

When you start preparing your tax files, you often wonder whether you can handle every detail manually. However, when you shift to automated Excel software, you quickly understand why thousands trust it for accurate calculations. Because rules frequently change, you need software that automatically updates tax slabs and deductions for F.Y. 2025–26.

Why Excel-Based Tax Software Matters

Excel-based tools empower employees to manage tax computations effortlessly. Since most people already use Excel, they immediately adapt to the software’s interface. Moreover, because Excel supports formulas and secure offline storage, you calculate taxes confidently without external tools.

The Growing Need for Automation in Tax Filing

As tax structures grow more complex each year, automation becomes essential. Employees increasingly prefer automated calculators because they reduce errors, save time, and ensure compliance. Consequently, using automatic tax software allows you to stay stress-free during filing season.

Key Features of the All-in-One Income Tax Software for F.Y. 2025–26

This software combines multiple tax functions into one Excel file, offering a smooth and reliable experience.

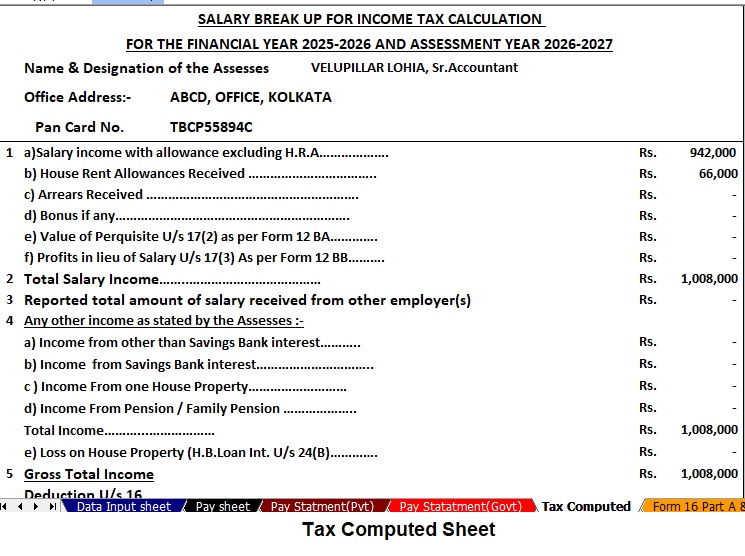

Automatic Tax Calculation

The tool automatically computes your taxable income, deductions, exemptions, and final tax liability, thus eliminating manual errors.

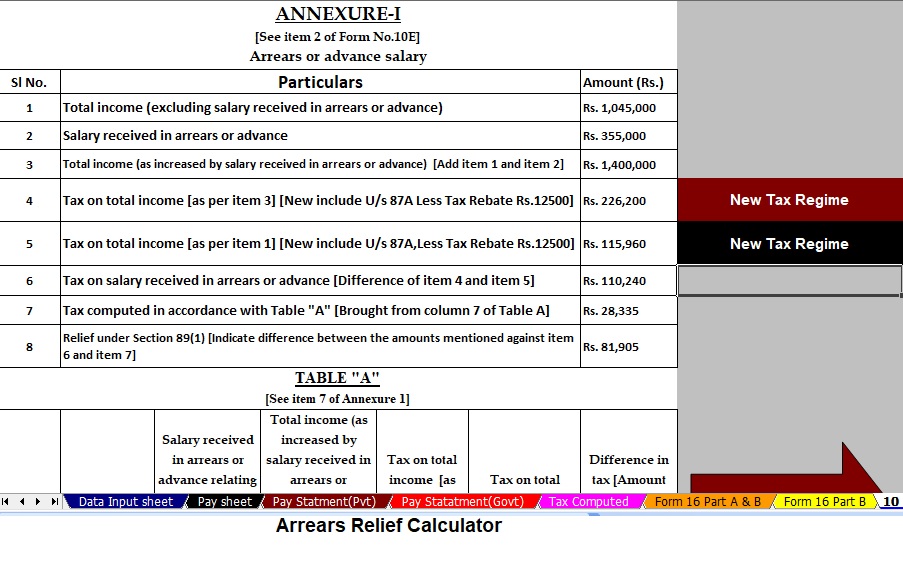

Form 10E Auto-Preparation

Since arrears relief under Section 89(1) requires Form 10E, the software auto-generates it based on your salary details.

Updated Tax Slabs as per F.Y. 2025–26

You no longer need to search for the latest tax rules; the software already includes updated slabs for both regimes.

Compatibility for Government and Non-Government Employees

Whether you earn through allowances or fixed salary components, the tool works for all salary structures.

Understanding Form 10E and Its Importance

Many taxpayers hesitate when they hear about Form 10E, yet it remains one of the most essential forms for claiming arrears relief.

What Is Form 10E?

Form 10E helps employees claim relief on salary arrears, advance salary, or family pension.

Why Employees Must Submit Form 10E

If you fail to submit Form 10E, the Income Tax Department may deny your arrears relief claim; therefore, it is mandatory.

How the Software Automatically Generates Form 10E

The Excel tool uses pre-entered salary details and arrears data to generate Form 10E instantly, ensuring accuracy and compliance.

Benefits of Using Automatic Excel Income Tax Software

Ensures Accuracy

Because formulas are already embedded, the tool produces accurate results instantly.

Saves Time and Effort

Instead of calculating each component manually, you rely on automation to complete your return quickly.

Reduces Human Errors

Even a small mistake can change your entire computation; however, this software prevents such issues.

Simplifies Arrears Calculation Under Section 89(1)

You can compute arrears relief with ease since the calculator includes pre-formatted Section 89(1) tables.

Step-by-Step Guide to Using the Software

Step 1 – Download the Excel File

Click the download link provided and save the file on your device.

Step 2 – Enter Personal Details

Add your PAN, name, address, and employer information.

Step 3 – Fill Salary Structure

Include salary components such as basic pay, allowances, bonuses, and deductions.

Step 4 – Add Deductions and Exemptions

Enter amounts under Sections 80C, 80D, and other eligible deductions.

Step 5 – Generate Form 10E Automatically

Once salary and arrears information is filled, the software prepares Form 10E immediately.

Step 6 – Review and Save Your Computation

Finally, review all pages and save the file for future reference.

Why Government and Non-Government Employees Need This Tool

Government employees handle multiple allowances; therefore, they need structured calculations. Similarly, non-government employees deal with variable salary components, making automated tools essential.

Advantages of Excel-Based Tax Software Over Online Tools

Works Without Internet

You can compute anytime since Excel works offline.

User-Friendly Interface

Even beginners navigate the tool easily.

High Customisation Options

You can modify fields based on your salary needs.

Tips to Avoid Tax Filing Mistakes With Excel Tools

Verify All Formula Fields

Ensure formulas have not been altered accidentally.

Keep Salary Slips Ready

Accurate figures ensure precise calculations.

Always Validate Form 10E Details

Check every field before submitting your return.

Conclusion

When you download the Automatic Income Tax Preparation Software All-in-One with Form 10E in Excel for F.Y. 2025–26, you empower yourself with accuracy, convenience, and stress-free tax filing. Since the tool works for both government and non-government employees, you enjoy complete coverage of every salary structure. Additionally, its automated approach ensures compliance and time savings. Therefore, using this software becomes one of the smartest decisions for the upcoming tax season.

FAQs

1. Is this software suitable for both old and new tax regimes?

Yes, it supports both regimes and calculates tax accordingly.

2. Can I use the tool without the internet?

Absolutely. The Excel-based software works offline.

3. Does the software include Form 10E?

Yes, it automatically prepares Form 10E for arrears relief claims.

4. Is the tool beginner-friendly?

Yes, even first-time users can navigate it easily.

5. Does it support the latest tax updates for F.Y. 2025–26?

Yes, all tax rules and slabs are updated.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

It automatically adjusts according to your salary format, whether you belong to a Government or Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]:

It accurately calculates arrears relief for the financial years ranging from 2000–01 to 2025–26. In addition, it instantly generates Form 10E for submission, ensuring precise tax relief computations. - Updated Form 16 (Part A & B and Part B):

This tool automatically generates Revised Form 16 (Part A & B and Part B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.