Introduction

Every salaried employee faces situations where salary revisions or promotions result in arrears being paid in a later year. Consequently, calculating income tax on these arrears becomes complex. Fortunately, the Automatic Income Arrears Relief Calculator with Form 10E for the F.Y.2025-26 simplifies this entire process. With this tool, you can easily compute tax relief under Section 89(1), saving both time and effort while ensuring complete accuracy.

Understanding Income Tax Arrears

What Are Income Tax Arrears?

Arrears refer to the difference between the salary due for previous years and the salary actually received later. For instance, if your salary for 2022–23 was revised in 2024–25, the additional payment you receive becomes arrears.

Why Arrears Occur for Salaried Employees

Salary arrears occur due to delayed increments, promotions, or retrospective pay revisions. As a result, you may end up paying higher taxes for the current year since the arrears get added to your present income.

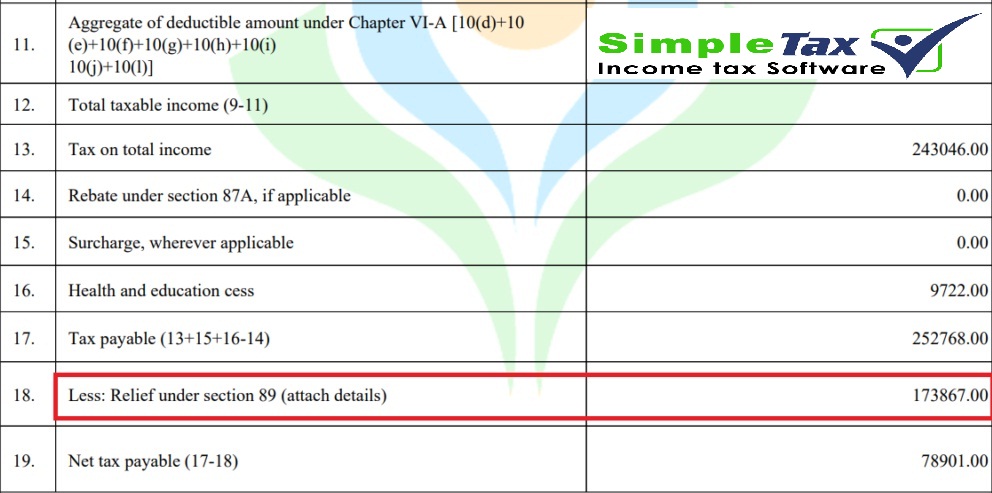

Section 89(1) of the Income Tax Act provides tax relief to employees who receive salary arrears or advance payments.

Meaning and Importance

Section 89(1) offers relief when you receive salary arrears or advances that push you into a higher tax slab. It ensures you are taxed fairly by spreading the income across the relevant years.

Eligibility for Relief

Any taxpayer who receives arrears or advance salary can claim relief under Section 89(1) by filing Form 10E before filing their Income Tax Return (ITR).

Why Use Form 10E?

You must file Form 10E to claim relief under Section 89(1); therefore, always submit it before filing your income tax return. Without filing this form, your claim for tax relief will be rejected by the Income Tax Department. Therefore, using Form 10E ensures transparency and compliance with tax laws.

Challenges in Manual Arrears Calculation

Manually calculating tax relief is cumbersome. You must compute taxes for each relevant year, compare differences, and determine the relief manually. This process is prone to mistakes, especially if you handle multiple financial years or income components.

Introducing the Automatic Income Arrears Relief Calculator

The Automatic Income Arrears Relief Calculator with Form 10E in Excel for F.Y.2025-26 automates the entire computation. It uses predefined formulas to determine the correct relief amount instantly. Furthermore, it generates a ready-to-file Form 10E, making tax filing effortless.

Features of the Excel-Based Calculator

- Automated Calculations – Simply input your salary details, and the tool does the rest.

- Built-In Form 10E Generator – Automatically prepares Form 10E with accurate figures.

- Multi-Year Comparison – Calculates tax for multiple financial years seamlessly.

- User-Friendly Design – You don’t need any technical skills; just fill in the data.

- Error-Free Output – Reduces the chances of calculation errors drastically.

Step-by-Step Guide to Using the Calculator

Step 1: Input Income Details

Enter your total income, deductions, and arrear details in the respective fields.

Step 2: Enter Arrear Year and Amount

Specify the financial year and the arrear amount received.

Step 3: Auto-Compute Tax Relief

The calculator compares your tax liability with and without arrears for each year.

Step 4: Generate Form 10E

The tool automatically fills Form 10E, ready for submission on the income tax portal.

How the Calculator Simplifies Tax Compliance

With automation, you can now compute arrear relief in minutes instead of hours. Moreover, this tool minimizes errors, ensures accurate reporting, and helps you stay compliant with the Income Tax Department.

Benefits of Using the Automatic Calculator

- Saves Time: No manual computation required.

- Accurate Results: Built-in formulas guarantee precision.

- Free to Use: Available at no cost for all employees.

- Multi-User Support: Works for Govt., Non-Govt., and PSU employees alike.

Comparison: Manual vs Automatic Calculation

| Feature | Manual Calculation | Automatic Calculator |

| Accuracy | Prone to errors | 100% accurate |

| Time Required | High | Minimal |

| Ease of Use | Complex | Simple |

| Form 10E | Needs manual entry | Auto-generated |

Clearly, the automatic calculator stands out as a faster and more reliable alternative.

How to Download the Calculator

You can easily download the Automatic Income Arrears Relief Calculator with Form 10E for F.Y.2025-26 from trusted financial websites. Once downloaded, open it in Microsoft Excel and start using it right away.

System Requirements

- MS Excel 2003 or later

- Windows or macOS

- Basic Excel knowledge

Tips for Accurate Tax Arrears Filing

- Always verify arrear amounts from HR or payslips.

- Cross-check your Form 16 data before entry.

- Keep a record of previous years’ income tax details.

- Submit Form 10E before filing your ITR to avoid rejection.

Conclusion

In conclusion, the Free Automatic Income Arrears Relief Calculator with Form 10E for F.Y.2025-26 is a must-have tool for every taxpayer dealing with salary arrears. It not only saves time and effort but also ensures full compliance with tax laws. Automating complex calculations it makes your tax filing journey smooth, fast, and accurate.

FAQs

- Is Form 10E mandatory for claiming relief under Section 89(1)?

Yes, it is mandatory to submit Form 10E before filing your ITR to claim arrears relief. - Can Non-Government employees use this calculator?

Absolutely! The calculator is designed for both Government and Non-Government employees. - Does this Excel tool require an internet connection?

No, once downloaded, it works offline without any internet requirement. - How does the calculator compute relief automatically?

It uses pre-built Excel formulas to compare tax liabilities across years and determine relief instantly. - Is this calculator updated for F.Y.2025-26?

Yes, it includes the latest tax rules and slab rates as per the Budget 2025-26. - Download Automatic Income Arrears Relief Calculator with Form 10E for F.Y.2025-26