Understanding income tax can sometimes feel like trying to solve a puzzle with missing pieces. Yet, when you get the right tools, the entire picture becomes clear and manageable. That’s why a Free Download Automatic Income Tax Preparation / Calculator in Excel All-in-One with Form 10E for the F.Y. 2025-26 is extremely helpful. Not only does it simplify calculations, but it also ensures accuracy and saves time for both Government and Non-Government employees. Just like having a smart assistant in your pocket, this Excel tool guides you smoothly through your tax details.

Table of Contents

| Sr# | Headings |

| 1 | Introduction to Automatic Income Tax Excel Tools |

| 2 | Why Use an Excel-Based Income Tax Calculator? |

| 3 | Key Features of the All-in-One Excel Tax Tool |

| 4 | Benefits for Government Employees |

| 5 | Advantages for Non-Government Employees |

| 6 | How Form 10E Works with the Excel Tool |

| 7 | Step-by-Step Guide to Using the Tax Calculator |

| 8 | Understanding Section 89(1) Relief |

| 9 | Accuracy and Error Reduction |

| 10 | Customizable Options for Users |

| 11 | How the Calculator Helps with Old vs New Tax Regime |

| 12 | Tips for Using Income Tax Excel Tools for FY 2025-26 |

| 13 | Safety and Trust of Using Excel Tools |

| 14 | Why This Free Tool Stands Out |

| 15 | Conclusion |

1. Introduction to Automatic Income Tax Excel Tools

When tax season approaches, many individuals start worrying about how to calculate their tax liability correctly. Thankfully, Income Tax Excel Tools for FY 2025-26 make this task easier. They help you compute your tax quickly and guide you through exemptions, deductions, rebates, and reliefs.

2. Why Use an Excel-Based Income Tax Calculator?

Excel-based tax calculators are simple, lightweight, and extremely efficient. Since Excel is commonly used in offices and homes, the tool integrates seamlessly into daily workflows. Moreover, the calculator is automatic, meaning it performs all computations instantly—saving time and reducing errors.

3. Key Features of the All-in-One Excel Tax Tool

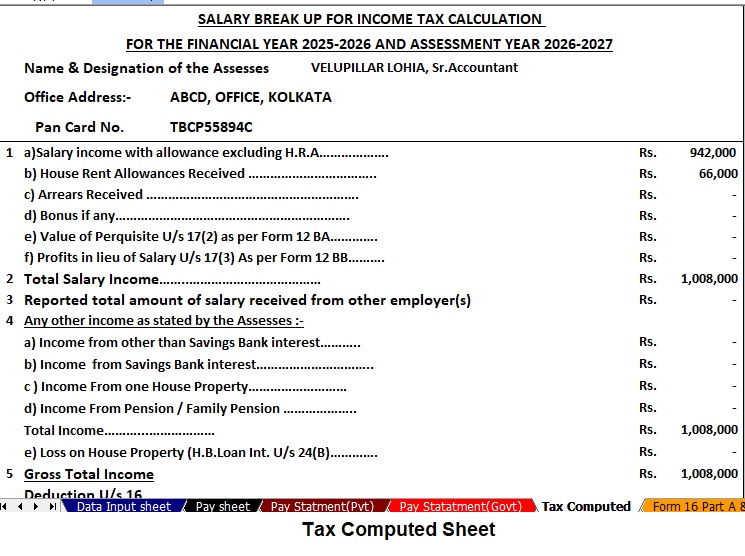

This Automatic Income Tax Preparation / Calculator in Excel All-in-One offers various features such as:

- Auto Calculation of tax liability

- Income Tax Slab Finder

- Integrated Form 10E Sheet

- Section 80D, 80C, and 80CCD(1B) deductions

- Arrears Relief Calculator

- Old vs New Tax Regime Comparison

Each feature works smoothly, helping employees calculate taxes with confidence.

4. Benefits for Government Employees

Government employees often receive multiple allowance components, arrears, and sometimes pension-related adjustments. This Excel tool helps them:

- Track salary details

- Enter arrears accurately

- Apply eligible exemptions

- Calculate relief under Section 89(1)

- Generate Form 10E instantly

5. Advantages for Non-Government Employees

Non-government employees also benefit significantly. They can:

- Easily manage salary breakup

- Add investment details

- Calculate HRA exemption

- Compare regimes

- Download and print their tax sheet

6. How Form 10E Works with the Excel Tool

Form 10E is essential when claiming arrears relief. This Excel tool includes a dedicated section where users simply input past salary, arrears amount, and relevant year details. The tool automatically prepares Form 10E in a ready-to-submit format.

7. Step-by-Step Guide to Using the Tax Calculator

Using the tool is as simple as:

- Open the Excel file

- Select your category (Govt or Non-Govt)

- Enter your personal details

- Enter salary and allowances

- Add deductions

- Check tax summary

- Generate Form 10E if needed

8. Understanding Section 89(1) Relief

Section 89(1) offers relief when employees receive arrears or advance salary. The tool automatically compares tax from previous years with updated figures, giving correct relief amounts.

9. Accuracy and Error Reduction

Since manual calculations can lead to errors, the automated formulas in this Excel tool ensure accurate and error-free results. Additionally, built-in validations prevent incorrect entries.

10. Customizable Options for Users

Users can adjust salary heads, add new deductions, or update values as required. The tool remains flexible and user-friendly throughout the process.

11. How the Calculator Helps with Old vs New Tax Regime

Choosing between regimes is crucial. The Excel tool provides a clear comparison chart, showing:

- Tax under the Old Regime

- Tax under the New Regime

- The difference between the two

This ensures better financial decision-making.

12. Tips for Using Income Tax Excel Tools for FY 2025-26

Here are useful tips:

- Always enter accurate salary figures

- Cross-check investment proofs

- Compare both tax regimes

- Save a backup of your Excel file

- Update tool version if available

13. Safety and Trust of Using Excel Tools

Since the file runs offline in your system, there is no risk of data theft. You stay in control of your details, making the Excel tool a trusted choice.

14. Why This Free Tool Stands Out

Unlike other tools, this one is free, easy to use, and specially designed for FY 2025-26. It includes Form 10E, arrears relief, and detailed tax summaries—making it a complete solution for every employee.

15. Conclusion

In conclusion, the Free Automatic Income Tax Preparation / Calculator in Excel All-in-One with Form 10E is a smart, practical, and effective tool for both Government and Non-Government employees. With its user-friendly format, accurate calculations, and essential features, it truly simplifies tax preparation for the financial year 2025-26.

FAQs

1. Is this Excel Tax Calculator free to download?

Yes, the tool is completely free for all users.

2. Can Government employees use this calculator?

Absolutely. It includes allowances and features specific to Government employees.

3. Does the tool support Form 10E preparation?

Yes, it automatically generates Form 10E based on user inputs.

4. Is the calculator suitable for Non-Government employees?

Yes, it covers all salary components commonly used in private-sector employment.

5. Does it work for both Old and New Tax Regimes?

Yes, the tool compares both regimes and suggests the better option.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for the Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

It automatically adjusts according to your salary format, whether you belong to a Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Automatic Income Tax Arrears Relief Calculation U//s 89(1) with Form 10E Form 16 (Part A & B and Part B):

This tool automatically generates Revised Form 16 (Part A & B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.