Understanding Section 87A Rebate in Income Tax

The Income Tax rebate under Section 87A is a significant relief for individuals with lower income levels in India. Introduced to ease the financial burden on taxpayers, this provision allows eligible individuals to reduce their tax liability by a specified amount. Unlike exemptions that lower taxable income, this rebate directly cuts down the income tax payable.

For F.Y. 2025-26, Section 87A ensures that resident individuals within certain income thresholds can effectively reduce or even nullify their income tax liability, thereby helping them save more of their hard-earned money.

Eligibility Criteria for Section 87A Rebate

To claim the rebate under Section 87A of the Income Tax Act, individuals must satisfy specific conditions. Let us explore them in detail:

- Residential Status: Only resident individuals in India are eligible. Non-resident taxpayers (NRI) cannot claim this rebate.

- Type of Taxpayer: The benefit applies solely to individual taxpayers. It is not available to firms, LLPs, companies, or Hindu Undivided Families (HUFs).

- Income Thresholds:

- Under the new tax regime, individuals with a net taxable income up to ₹7,00,000 can claim a rebate of up to ₹25,000.

- Under the old tax regime, individuals with a net taxable income up to ₹5,00,000 are eligible for a rebate of up to ₹12,500.

By ensuring that taxable income falls within these limits, eligible taxpayers can reduce their net tax liability to zero.

How Section 87A Rebate Works in Practice

The rebate under Section 87A functions by adjusting your final tax liability. Here’s how it is calculated:

- First, compute your gross total income.

- Deduct all eligible exemptions and deductions under various sections like 80C, 80D, 80CCD(1B), etc.

- Arrive at your net taxable income.

- If this net income does not exceed the specified limit, the rebate applies.

Example for New Tax Regime (F.Y. 2025-26):

- Net taxable income: ₹6,80,000

- Tax liability before rebate: ₹20,400

- Maximum rebate available: ₹25,000

- Final tax liability: ₹0

Example for Old Tax Regime (F.Y. 2025-26):

- Net taxable income: ₹4,90,000

- Tax liability before rebate: ₹12,000

- Maximum rebate available: ₹12,500

- Final tax liability: ₹0

Thus, the Section 87A rebate ensures complete tax relief if the tax payable is equal to or lower than the specified rebate amount.

Key Highlights of Section 87A Rebate

- Applies to Residents Only: Non-residents cannot claim this rebate.

- Rebate, Not Exemption: It reduces tax payable, not taxable income.

- Applicable to Both Regimes: Old and new tax regimes are covered, but thresholds differ.

- Automatically Applied: The rebate is applied while filing your Income Tax Return (ITR).

- Senior Citizens Benefit: Resident senior citizens (aged 60–80 years) also enjoy this benefit.

- Before Cess Calculation: The rebate applies before the 4% health and education cess.

- Budget Revisions Possible: Each Union Budget may revise limits or rebate amounts.

Importance of Section 87A in Tax Planning

Tax planning is critical for maximising savings. By carefully claiming deductions under sections like 80C, 80D, 80CCD(1B), 24(b) (housing loan interest), and others, taxpayers can lower their net taxable income to within the rebate threshold. This enables them to utilise Section 87A fully and bring down their tax liability to zero.

For example, if your taxable income is ₹7,20,000 under the new regime, by investing in NPS (under Section 80CCD(1B)) or insurance (under Section 80C), you can reduce your income to below ₹7,00,000 and qualify for the rebate.

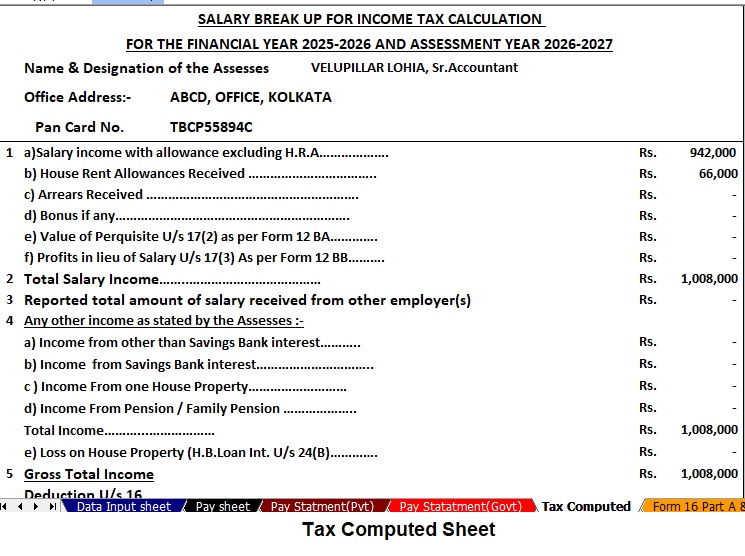

Download the All-in-One Automatic Income Tax Calculator in Excel with Form 10E for F.Y. 2025-26, designed for both Government and Non-Government employees.

Manual tax computation can be confusing and prone to errors. To simplify the process, you can download the Automatic Income Tax Preparation Software All-in-One in Excel for F.Y. 2025-26.from the above link

Key Features of the Excel-Based Calculator

- Instant Tax Computation Sheet: Prepares an accurate tax sheet in seconds based on Budget 2025

- Covers Govt. & Non-Govt. Employees: Includes an inbuilt salary structure tailored for both categories.

- Automatic Salary Sheet: Automatically generates salary details, eliminating the need for manual entry.

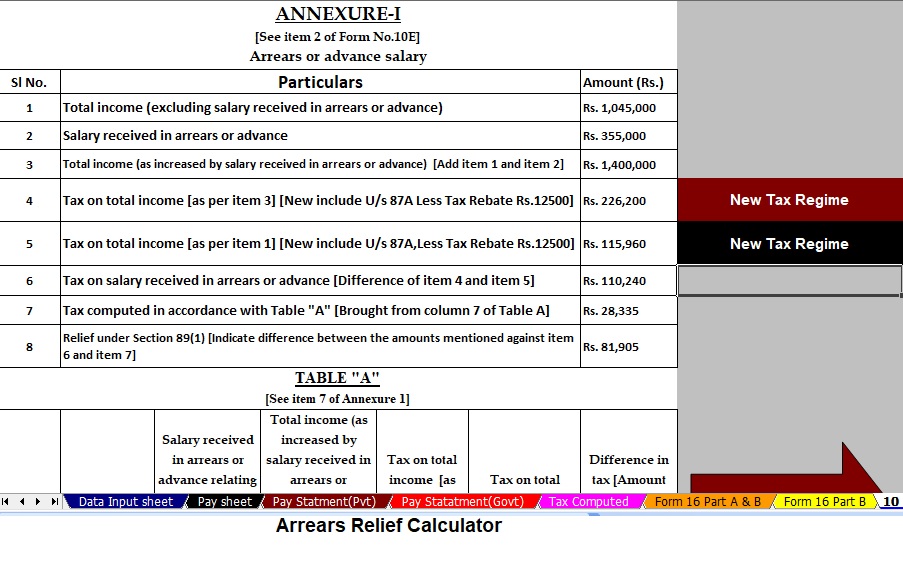

- Form 10E Integrated: Assists in accurate arrears relief calculation under Section 89(1) with Form 10E.

- User-Friendly Interface: Designed for individuals with no technical expertise.

- Error-Free Calculations: Ensures compliance with current tax rules.

This software is particularly valuable for Government and Non-Government employees, as it allows seamless calculation of tax liability, including the Section 87A rebate.

Benefits of Using an Automatic Excel-Based Income Tax Calculator

- Time-Saving – The automated process reduces time spent on manual calculations.

- Accuracy Guaranteed – Minimises human errors in computing taxable income.

- Comprehensive – Covers multiple heads of income, deductions, and tax regimes.

- Budget-Compliant – Updated as per the latest Budget 2025

- Form 10E Support – Crucial for arrear relief calculation and compliance with Section 89(1).

- Tailored for Employees – Both Government and Non-Government employees can easily compute their exact tax liability.

Section 87A Rebate: A Tool for Maximising Savings

When combined with efficient tax planning and Automatic Income Tax Software, Section 87A becomes an excellent tool for reducing tax burden. By leveraging deductions and ensuring income stays within the rebate threshold, taxpayers can save significantly.

Employees who frequently deal with salary arrears or additional income components benefit most from using Excel-based calculators with Form 10E integration, as it ensures compliance and optimal use of rebates.

Conclusion

The Income Tax rebate under Section 87A for F.Y. 2025-26 is a valuable provision that allows resident individuals to enjoy relief from income tax if their net taxable income falls within specified thresholds. By understanding its eligibility, working, and integration with tax planning, taxpayers can maximise their savings.

Moreover, with the help of the Automatic Income Tax Preparation Software All-in-One in Excel, both Government and Non-Government employees can easily compute their tax liability, ensure compliance with Budget 2025, and take full advantage of Section 87A.