Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you instantly simplify the entire process. Since more employees actively search for convenient solutions, you naturally appreciate a tool that saves time, boosts accuracy, and reduces confusion. Moreover, because the F.Y. 2025–26 rules […]

Free Download Automatic Income Tax Preparation / Calculator in Excel All in One with Form 10E for the Government and Non-Government Employees for the F.Y. 2025-26

Understanding income tax can sometimes feel like trying to solve a puzzle with missing pieces. Yet, when you get the right tools, the entire picture becomes clear and manageable. That’s why a Free Download Automatic Income Tax Preparation / Calculator in Excel All-in-One with Form 10E for the F.Y. 2025-26 is extremely helpful. Not only […]

Getting Expensive Wedding Gifts? They’re Tax-Free—But Only If You Keep These Proofs Handy | With Automated Income Tax Preparation Software All in One for the Non-Government Employees for the F.Y. 2025-26

Have you ever wondered whether those expensive wedding gifts—like gold sets, cash envelopes, or even a car—are taxable? Surprisingly, they’re not, but only when you follow the rules and keep the right proofs. Think of it like carrying an umbrella: it only helps if you actually take it with you. Similarly, your gift remains tax-free […]

Free Download Automatic Income Tax Preparation Software / Calculator All in One in Excel for the Non-Government Employees for the FY 2025-26

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead you through every twist and turn? That’s exactly what the Free Automatic Income Tax Preparation Software / Calculator All in One in Excel for the Non-Government Employees for FY 2025-26 does. This […]

When Should You Switch Your Home Loan? Year-by-Year Guide with Automatic Income Tax Preparation Software All-in-One with Form 10E for Govt and Non-Govt Employees for FY 2025–26

Introduction Have you ever wondered whether keeping your current Home Loan is costing you more than it should? Many people continue with the same lender for years simply because switching feels confusing or risky. However, when done at the right time, shifting your Home Loan can save you thousands of rupees—just like choosing a smoother, […]

Free Download Automatic Income Arrears Relief Calculator with Form 10E for the F.Y.2025-26

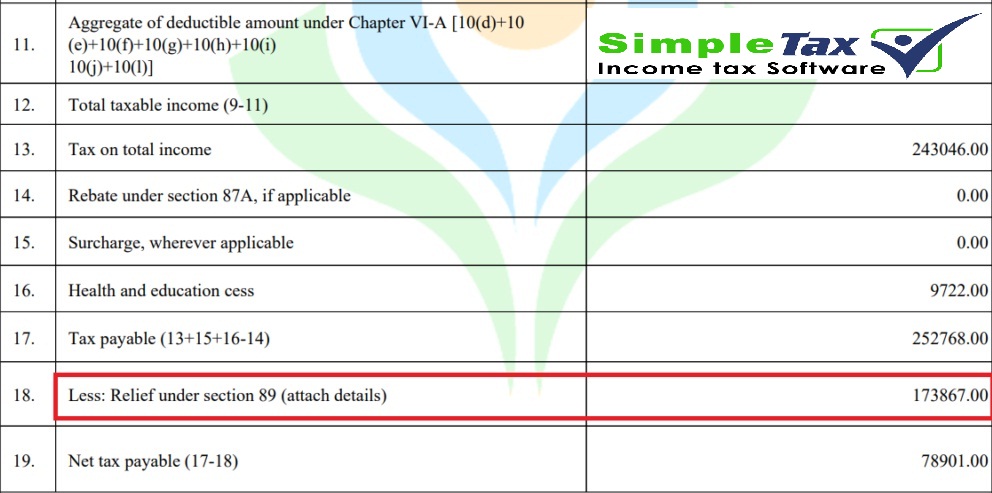

Introduction Every salaried employee faces situations where salary revisions or promotions result in arrears being paid in a later year. Consequently, calculating income tax on these arrears becomes complex. Fortunately, the Automatic Income Arrears Relief Calculator with Form 10E for the F.Y.2025-26 simplifies this entire process. With this tool, you can easily compute tax relief […]

Free Download Automated Income Tax Preparation Software or Calculator All in One in Excel for the Non-Government Employees for FY 2025-26

Introduction Are you tired of manually calculating your income tax every year? If yes, then you’re not alone. Thousands of non-government employees face the same struggle while figuring out their taxable income, deductions, and final tax liability. But what if you could do all this automatically? Here’s some great news — the Free Automated Income […]

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this issue every year when arrears are paid for previous financial years. Thankfully, the Income Tax Act’s Section 89(1) provides a simple solution — and with Form 10E, you can claim tax relief […]

Why Choose the New Tax Regime as per Budget 2025 with Automated Income Tax Preparation Software All in One in Excel for the Non-Government Employees FY2025-26

The Union Budget 2025 introduced significant reforms to simplify the Indian taxation system, particularly through the New Tax Regime. For non-government employees, this new structure offers a straightforward and transparent approach to managing taxes. When combined with an Automated Income Tax Preparation Software All-in-One in Excel, the benefits multiply, saving both time and money. Let’s […]

Rebate U/s 115BAC for FY 2025-26 as per Budget 2025 with Automatic Income Tax Form 10E

The Rebate U/s 115BAC for FY 2025-26 under the New Tax Regime introduces a simpler, fairer, and more transparent way of calculating taxes. As per Budget 2025, the new regime continues as the default option for all individuals and HUFs. However, if you receive arrears or advance salary, you must manually file Form 10E online […]